Last week, I had an experience that perfectly illustrates why small businesses can’t afford to ignore PCI DSS compliance requirements – even when they think they’re being helpful to their customers.

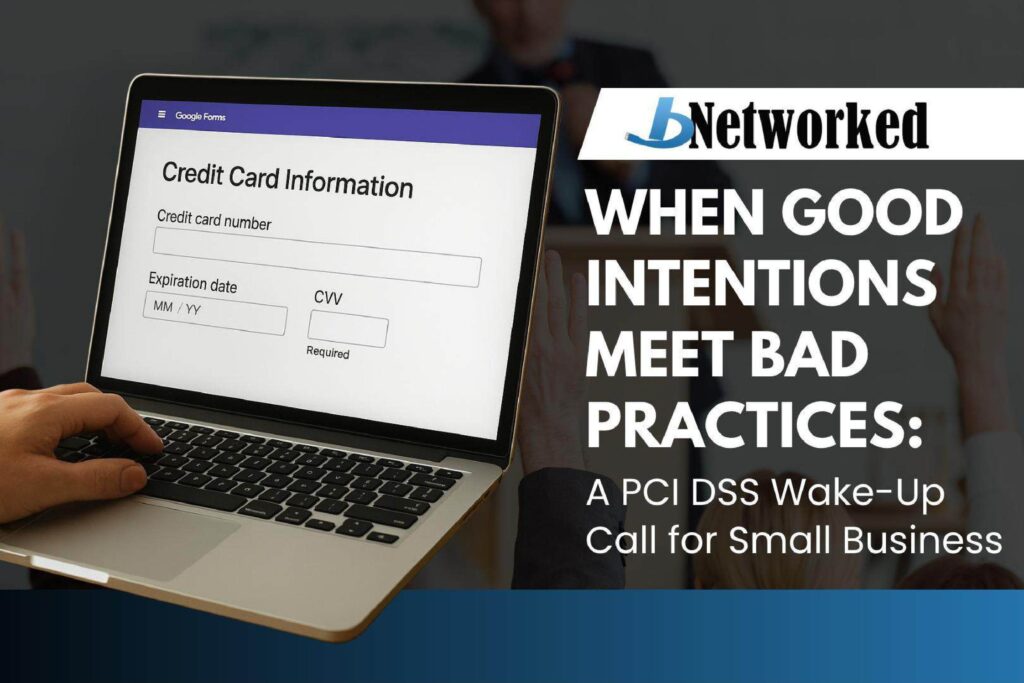

The Story: An Auction Win Turned Security Red Flag

I was participating in an online sports memorabilia auction and successfully won an item I’d been watching. The business had my credit card information on file from the bidding process, which they used to charge the auction amount – so far, so good. However, when it came time to arrange shipping, things took an alarming turn.

Instead of using their existing payment processing system, they sent me a link to a Google Docs form requesting my credit card number, expiration date, and CVV code – all in plain text fields within a basic online form.

I immediately declined and explained the security risks, requesting alternative payment arrangements (which they graciously accommodated). But the experience left me wondering: how many customers would have simply filled out that form without a second thought?

The Hidden Dangers of “Simple Solutions”

This scenario represents a perfect storm of PCI DSS violations and security vulnerabilities:

- Data Storage Violations: Google Forms aren’t designed for secure payment data collection. Any information entered would be stored in plain text, accessible to anyone with form permissions.

- Transmission Security: Credit card data transmitted through unsecured forms lacks the encryption required by PCI DSS standards.

- Access Controls: There’s no way to restrict who can view submitted responses or ensure they’re handled by authorized personnel only.

- Data Retention: Without proper controls, this sensitive information could remain accessible indefinitely.

The Real Cost of Non-Compliance

When small businesses accept credit cards, they enter into agreements with payment processors that include PCI DSS compliance requirements. Many business owners either don’t realize this or assume the requirements don’t apply to their “small operation.” The reality is far different.

Financial Liability: In the event of a data breach, non-compliant businesses can face:

- Fines from payment card brands ranging from $5,000 to $100,000 per month

- Assessment fees from acquiring banks

- Potential lawsuits from affected customers

- Complete loss of ability to accept credit card payments

Reputational Damage: News of a data breach – especially one involving basic security oversights – can destroy customer trust that took years to build.

Operational Disruption: Breach investigations, remediation efforts, and compliance audits can consume enormous amounts of time and resources.

What Small Businesses Need to Know

PCI DSS compliance isn’t optional – it’s a contractual obligation that comes with accepting credit cards. The good news is that most small businesses fall under PCI DSS Level 4 requirements, which are more manageable than enterprise-level compliance but still require attention to key areas:

- Secure Payment Processing: Use payment processors that handle tokenization and encryption rather than collecting raw card data yourself.

- Access Controls: Limit who has access to payment systems and customer data, with unique user IDs and strong authentication.

- Network Security: Implement firewalls, secure Wi-Fi networks, and keep all systems updated with current security patches.

- Data Protection: Never store sensitive authentication data (CVV codes, magnetic stripe data) and limit cardholder data retention to business necessity.

- Regular Monitoring: Implement logging and monitoring systems to detect and respond to potential security incidents.

Moving Beyond Compliance to Security

While PCI DSS provides a framework for protecting payment data, true cybersecurity requires a broader approach. Small businesses should consider compliance as the minimum baseline, not the ultimate goal.

This means implementing comprehensive cybersecurity policies, regular employee training, incident response plans, and working with qualified IT security professionals who understand both compliance requirements and practical threat mitigation.

The Bottom Line

The sports memorabilia business I dealt with had good intentions – they wanted to make the shipping payment process convenient for their customers. But convenience without security creates liability that could threaten the entire business.

Small businesses across Atlantic Canada and beyond need to recognize that accepting credit cards comes with serious responsibilities. The cost of implementing proper security controls is always less than the cost of dealing with a data breach.

If you’re a small business owner wondering about your PCI DSS obligations or current security posture, don’t wait for a wake-up call like the one I witnessed. The time to address compliance and security is now, before good intentions turn into costly mistakes.

Are you confident in your business’s PCI DSS compliance and overall cybersecurity posture? Contact us to discuss how we can help protect your business and your customers’ sensitive data.